In today’s digital economy, your credit score is more than just a number—it’s a key that can unlock opportunities or close doors. Whether you’re applying for a loan, trying to rent an apartment, or even job hunting, your credit score plays a critical role in how others view your financial reliability.

But what exactly is a credit score? And more importantly—how can you improve it without getting overwhelmed?

Let’s break it down in simple terms and show you practical steps you can take today to build a better financial future.

What Is a Credit Score?

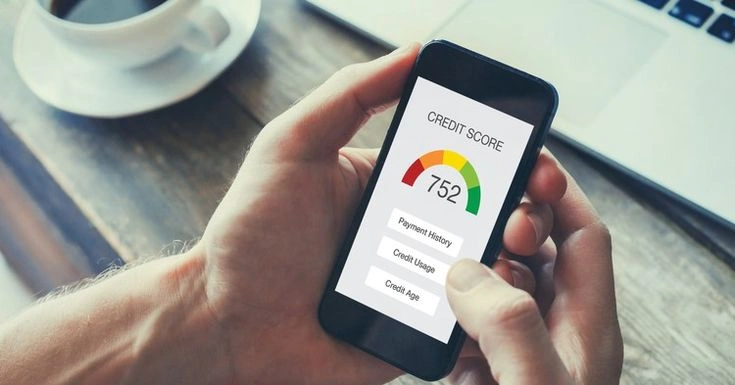

A credit score is a three-digit number that reflects your creditworthiness—basically, how likely you are to repay borrowed money. Lenders, banks, landlords, and even employers can use it to judge how financially responsible you are.

In most scoring models (like FICO or VantageScore), scores range from 300 to 850:

- 300–579 = Poor

- 580–669 = Fair

- 670–739 = Good

- 740–799 = Very Good

- 800–850 = Excellent

The higher your score, the more likely you are to qualify for loans, get approved faster, and enjoy lower interest rates.

What Affects Your Credit Score?

Your score is calculated based on several factors. Here’s a quick breakdown of what credit bureaus typically look at:

- Payment history (35%) – Do you pay your bills on time?

- Credit utilization (30%) – How much of your available credit are you using?

- Credit history length (15%) – How long have your accounts been open?

- Credit mix (10%) – Do you have a healthy mix of credit cards, loans, etc.?

- New credit inquiries (10%) – Have you applied for multiple new accounts recently?

Even small improvements in these areas can make a meaningful impact on your score.

Why Your Credit Score Matters?

Think you can ignore your credit score? Think again. A poor credit score can:

- Make it hard to qualify for loans

- Increase your interest rates

- Prevent you from renting homes

- Affect your ability to get a job in certain industries

- Limit access to better credit cards and financial tools

On the other hand, a good credit score can literally save you thousands of dollars in interest over time.

How to Improve Your Credit Score—Starting Today

Improving your credit score isn’t an overnight process, but with steady action, you’ll see results. The good news? You don’t need a financial degree to get started. Here’s how you can make a difference starting right now:

1. Start by Checking Your Credit Report

Visit a trusted credit bureau (like Experian, Equifax, or TransUnion) and request your free credit report. Look for errors—like accounts you never opened or late payments you never missed. If you find mistakes, dispute them immediately. Correcting inaccurate data alone can give your score a helpful bump.

2. Pay Your Bills on Time, Every Time

Late payments are one of the fastest ways to damage your score. Set up automatic payments or reminders to make sure nothing slips through the cracks. Even one missed payment can set you back, so consistency is key.

3. Lower Your Credit Card Balances

If you’re using more than 30% of your available credit, lenders may see that as a red flag. Try to pay off balances or at least reduce them significantly. The lower your credit utilization, the better it looks on your record.

4. Avoid Opening Too Many New Accounts at Once

Each time you apply for credit, a “hard inquiry” appears on your report. Too many of these in a short period can hurt your score. Be selective and only apply when necessary.

5. Keep Older Accounts Open

Even if you don’t use an old credit card much, keeping it open shows a longer credit history—one of the factors that boosts your score. Just make sure there are no annual fees involved.

Long-Term Habits for a Healthier Credit Score

Once you’ve taken the first steps, focus on building healthy credit habits over time. Use credit responsibly, pay off debt gradually, and monitor your score every few months to stay on track. Improving your credit is a marathon, not a sprint—but every good decision today brings you closer to financial freedom tomorrow.

Final Thoughts

Understanding your credit score doesn’t have to be intimidating. Once you know how it works and what influences it, you can take control and improve it—one smart step at a time. Whether you’re planning to buy a home, start a business, or simply build peace of mind, your credit score matters.

Start today. Check your report, make a small payment, or adjust how you use your credit card. Over time, those simple moves will transform your financial standing in powerful ways.